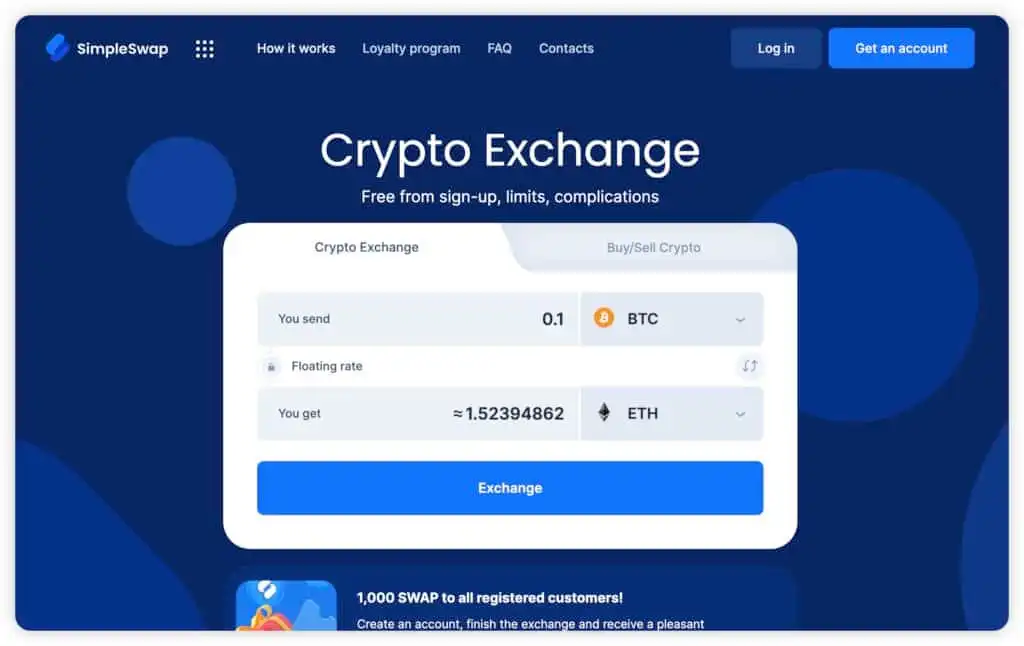

Earn Passive Income with Crypto Staking on SimpleSwap

Staking has become a popular method for earning rewards while supporting blockchain networks. At SimpleSwap on simpleswap, we provide guidance and tools to help you explore staking opportunities. While our main focus remains seamless crypto swaps, the simpleswap exchange allows you to acquire staking-eligible tokens easily and efficiently.

Staking means locking your crypto assets to validate transactions and maintain network security, earning rewards in return. Through simpleswap, you can perform a simple swap to get top staking coins such as Ethereum or Cardano. Our simpleswap exchange streamlines the process, preparing your portfolio for staking without unnecessary complexity.

Whether you are a staking beginner or seeking to refine your strategy, SimpleSwap offers educational resources on simpleswap. Learn how staking works, its advantages, and how our simple swap features can complement your staking journey through the simpleswap exchange.

Understanding Crypto Staking

Crypto staking is like earning interest in the blockchain world. By staking, you commit tokens to a network's proof-of-stake (PoS) system. On simpleswap, guides explain the staking process, and you can use the simpleswap exchange for fast swaps into staking-compatible assets.

Typically, staking requires holding a minimum amount of tokens in a wallet and delegating them to a validator. Rewards depend on your stake and network performance. SimpleSwap simplifies the first step by enabling instant simple swap transactions to build your staking portfolio via the simpleswap exchange.

Blockchains like Ethereum 2.0, Polkadot, and Solana rely on staking. Need to swap fiat or other cryptocurrencies for these tokens? Use simpleswap for a quick simple swap on our simpleswap exchange.

Staking can be solo by running a node or through pools for easier participation. Our blog on simpleswap covers these options, guiding you while using SimpleSwap for any required simple swap.

Benefits of Staking with SimpleSwap

Staking generates passive income, often with APYs exceeding traditional savings. At simpleswap, our simpleswap exchange enables you to swap for high-yield staking tokens, helping you start earning quickly.

Staking strengthens network security and decentralization. By participating, you support blockchain integrity. SimpleSwap at simpleswap provides seamless simple swap tools, ensuring you hold the right tokens for staking via the simpleswap exchange.

Unlike mining, staking is energy-efficient and accessible. No costly hardware is needed—stake directly from your wallet. Use simpleswap to swap your holdings through the simpleswap exchange and join staking pools effortlessly.

Risks include validator penalties or lock-up periods limiting liquidity. With careful choices and SimpleSwap’s simple swap options on simpleswap, you can manage these effectively using the simpleswap exchange.

Step-by-Step Guide to Start Staking

First, choose a staking-supported cryptocurrency. Research options on simpleswap’s blog, then use our simpleswap exchange for a simple swap to acquire the necessary tokens.

Select a staking-compatible wallet, such as hardware or software options. Transfer your assets via a simple swap from simpleswap to your wallet using the simpleswap exchange.

Decide between solo staking or joining a pool. Pools are beginner-friendly. SimpleSwap at simpleswap can guide you through any preparatory simple swap via our simpleswap exchange.

Stake tokens following the network’s instructions. Monitor rewards and compound when possible. Adjust your portfolio with simple swap transactions on simpleswap via the simpleswap exchange.

Withdraw rewards or unstake when needed. Exchange earned tokens through SimpleSwap on simpleswap using a simple swap in our simpleswap exchange.

Popular Staking Cryptocurrencies on SimpleSwap

Ethereum (ETH) is a top choice after its PoS upgrade. Swap for ETH on simpleswap using our simpleswap exchange for easy acquisition.

Cardano (ADA) offers accessible staking with attractive yields. Acquire ADA through a simple swap at simpleswap via the simpleswap exchange.

Polkadot (DOT) supports staking via nomination pools. Get DOT quickly with a simple swap on simpleswap’s simpleswap exchange.

Solana (SOL) provides high-speed staking. Exchange for SOL easily on simpleswap using our simpleswap exchange.

Other options include Cosmos (ATOM) and Tezos (XTZ). Explore these on simpleswap and perform a simple swap via the simpleswap exchange to stake them.

Calculating Staking Rewards

Rewards vary by network, stake size, and total staked supply. Use tools on simpleswap to estimate earnings, and prepare by performing a simple swap on our simpleswap exchange.

APY can range from 5% to 20%+, influenced by inflation and validator performance. SimpleSwap at simpleswap helps you enter high-yield staking via a simple swap on the simpleswap exchange.

Compounding rewards by restaking can boost returns. Learn strategies on simpleswap and use our simpleswap exchange for related simple swaps.

Tax obligations apply to staking rewards. Consult professionals and track transactions, including those executed through simpleswap's simple swap on the simpleswap exchange.

Liquid Staking: Modern Flexibility

Liquid staking allows you to earn rewards while keeping your assets flexible through derivatives. On simpleswap, you can swap for liquid staking tokens like LSD using our simpleswap exchange for a simple swap.

Platforms such as Lido offer stETH for Ethereum. Acquire these easily with SimpleSwap on simpleswap via a simple swap through the simpleswap exchange.

Key benefits include the ability to trade staked assets without unstaking them. Explore liquid staking options on simpleswap and perform any required simple swap using the simpleswap exchange.

Risks include potential vulnerabilities in smart contracts. With careful selection and support from SimpleSwap on simpleswap, you can participate in liquid staking safely using the simple swap features.

Staking Compared to Other Yield Options

Unlike lending or yield farming, staking is network-specific. On simpleswap, you can easily transition between different yield methods using a simple swap on the simpleswap exchange.

Mining requires specialized hardware, while staking does not. Switch seamlessly using SimpleSwap on simpleswap via our simpleswap exchange.

DeFi yields can be higher but often come with more risk. Balance your portfolio with staking and rely on simpleswap for all related simple swap transactions through the simpleswap exchange.

Overall, staking is ideal for long-term holders. Start with assets obtained via SimpleSwap on simpleswap through a smooth simple swap on our simpleswap exchange.

FAQ: SimpleSwap Staking Questions

What is cryptocurrency staking?

Staking involves locking tokens to support a blockchain network and earn rewards. Learn more on simpleswap and use the simpleswap exchange to perform a simple swap into staking coins.

Does SimpleSwap provide staking services?

SimpleSwap primarily focuses on crypto exchanges but offers educational resources on staking. Acquire staking assets via a simple swap on simpleswap through the simpleswap exchange.

How do I select a staking pool?

Look for pool reliability and fees. Our blog on simpleswap offers detailed tips, and you can use the simpleswap exchange for the required simple swap to join a pool.

What risks are associated with staking?

Staking risks include price volatility and potential slashing penalties. Reduce risks by gaining knowledge from simpleswap and diversifying your assets with simple swaps on our simpleswap exchange.

Can I stake any cryptocurrency?

Only proof-of-stake (PoS) coins are eligible. Use simpleswap and the simpleswap exchange to perform a simple swap for staking-compatible tokens easily.

How long do I need to stake?

Staking periods differ depending on the network; some require lock-up times. Check the specifics on simpleswap and prepare your assets with a simple swap via the simpleswap exchange.

What is liquid staking?

Liquid staking allows you to earn rewards while keeping assets flexible through liquid tokens. Obtain these tokens on simpleswap using our simpleswap exchange for a simple swap.

How are staking rewards taxed?

In many jurisdictions, staking rewards are considered taxable income. Keep track using calculators and your simple swap history from the simpleswap exchange on simpleswap.

Can beginners stake crypto?

Yes, beginners can participate via staking pools. Follow guides on simpleswap and use the simpleswap exchange to perform your first simple swap into staking assets.

What wallet do I need for staking?

Wallet requirements depend on the blockchain network. Acquire staking-compatible assets through simpleswap using a simple swap on the simpleswap exchange.

How to calculate staking rewards?

Estimate rewards using APY and the amount staked. Use staking calculators on simpleswap and ensure your assets are ready with a simple swap via the simpleswap exchange.

Is staking environmentally friendly?

Yes, staking consumes significantly less energy than mining. Learn more on simpleswap and participate through a simple swap on our simpleswap exchange.

Can I unstake anytime?

Unstaking flexibility varies by network. Plan ahead using information from simpleswap, and convert or swap your tokens post-unstake with the simpleswap exchange.

What is slashing in staking?

Slashing is a penalty for validator misbehavior. Reduce risks by selecting reputable validators, guided by tips on simpleswap, and manage your assets with simple swaps on the simpleswap exchange.

How does staking affect crypto prices?

Staking can reduce circulating supply, potentially increasing token value. Monitor market trends and use simpleswap and the simpleswap exchange for quick swaps when needed.